“Aquarium Psycho”

Well Hello.

Are you one of the millions muttering “I work because I have to, not because I want to” while floundering to change this?

I help wannabe retirees make their 9-to-5s unnecessary by stock picking as a hobby (this is at times an understatement), so they can retire on their terms and conquer the terror of outliving their money.

Do you have urgency, solvency, and gender-ambiguous balls? Watch this demonstration. Launch your lifetime of investing. Earn your Findependence.

This is reel if you’re for real. Here’s what some Finatics say…

“Cole, you can officially call yourself a millionaire maker!!

I’d like to share some of my single day updates as well as the gut wrenching down days that I went through, however, following the FFF rules I came out in the sun!!”

Rick M.

California, USA

“Hi Cole, BREAKING NEWS!!! I have cracked the NZ$100,000 (USD$59,800) mark… It’s taken just over 12 months. Very happy!! Cheers Bishop”

Bishop & Fiona B.

Auckland, New Zealand

“Keen for a Zoom chat at the weekend? I’ve just made my annual salary in the last 2 days…

It’d be good to talk about ‘living off your investments’ if we could. Because I feel this could possibly be in the not too distant future.”

Dan R.

Cairns, Australia

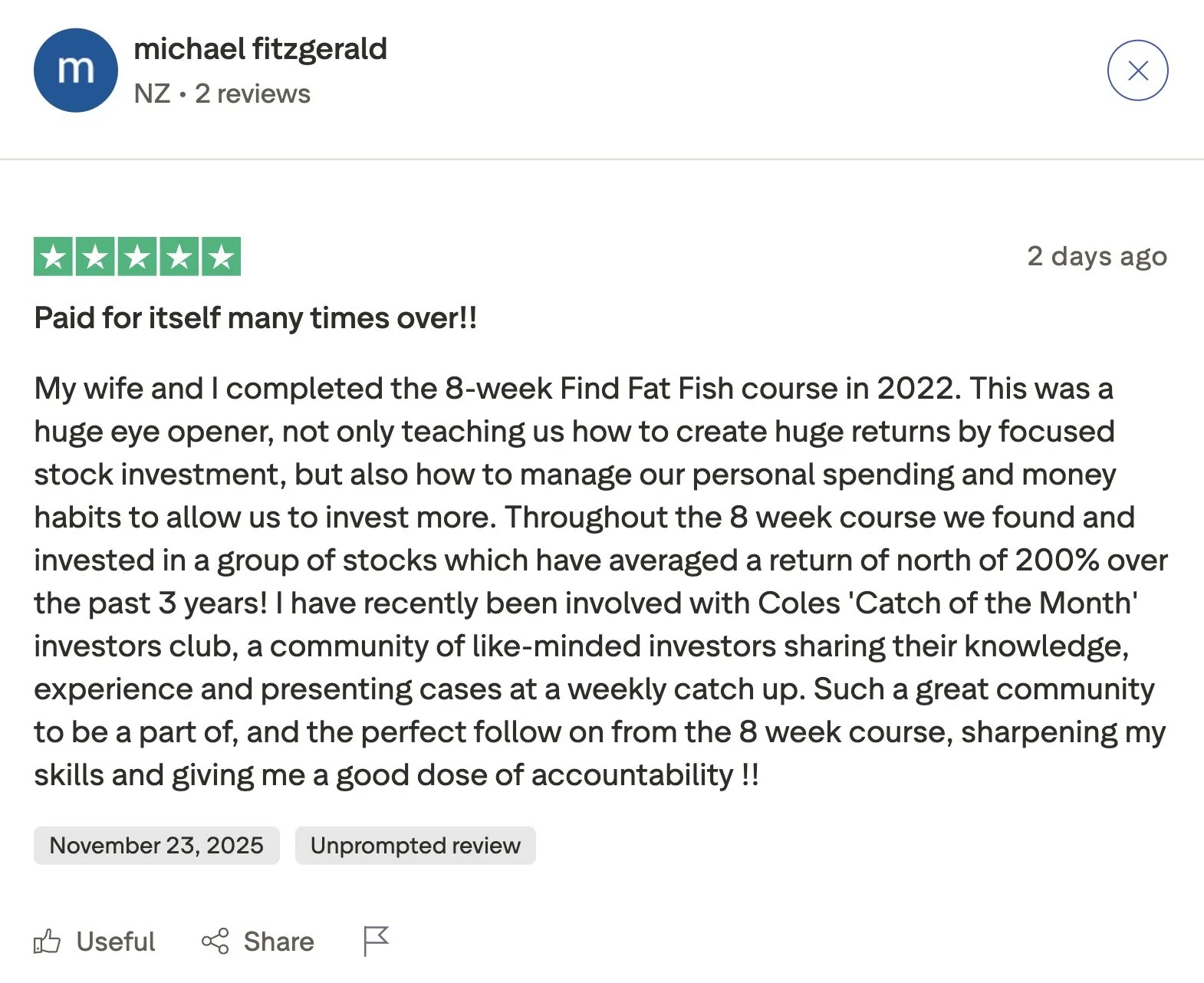

“Paid for itself many times over!!

My wife and I completed the 8-week Find Fat Fish course in 2022. This was a huge eye opener, not only teaching us how to create huge returns by focused stock investment, but also how to manage our personal spending and money habits to allow us to invest more. Throughout the 8 week course we found and invested in a group of stocks which have averaged a return of north of 200% over the past 3 years!”

Mike & Tess F.

Hawke’s Bay, New Zealand

“From Kindergarten Teacher to Confident Investor!

In 2024 I discovered Find Fat Fish and my eyes were opened to a whole new world of stock picking. With Cole’s unmatched coaching, I learned how to vet, pick, and trade with confidence in just eight weeks. There was no jargon and no unrealistic promises—just a simple yet comprehensive method that anyone can understand.

As a female and a kindergarten teacher, I could never have imagined the kind of success I’ve achieved with the portfolio I built as a result of the Find Fat Fish course.”

Karen C.

Bendigo, Australia

(I’m aware it sounds ridiculous. But in the hands of offishially serious clients, “Find Fat Fish helps amateur investors make more by stock picking as a hobby than they earn in their jobs” plays out, long-term, as a probability & understatement. Because the math of compound interest dictates that investing is far more powerful than income.)

"Fat Fish on Bed of Greens"

About The Mascot

Fat Fish Are Opportunities To Turn 1 Month Of Expenses Into 1 Year Of Freedom. Find Fat Fish® is personal training for personal finance.

I will help you catch Your First Stock®, then build your own portfolio, replacing needless fear with fact-based faith, going on offense without sacrificing your defense, until you've learned to fish forever and don't need me or anyone. (If, and only if, you’re ready.)

“Twenty years in this business convinces me that any normal person using the customary three percent of the brain can pick stocks just as well, if not better, than the average Wall Street expert.”

About The Mission

“Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime.”

Almost no one is prepared, psychologically or financially, for the post-revenue environment of retirement. So the two problems I’m most devoted to helping determined people solve are “I work because I have to, not because I want to… and after all this school and work and sacrifice, I am faced with a codnundrum: never retire, or outlive my money.”

“Rich Dad, Pole Dad”

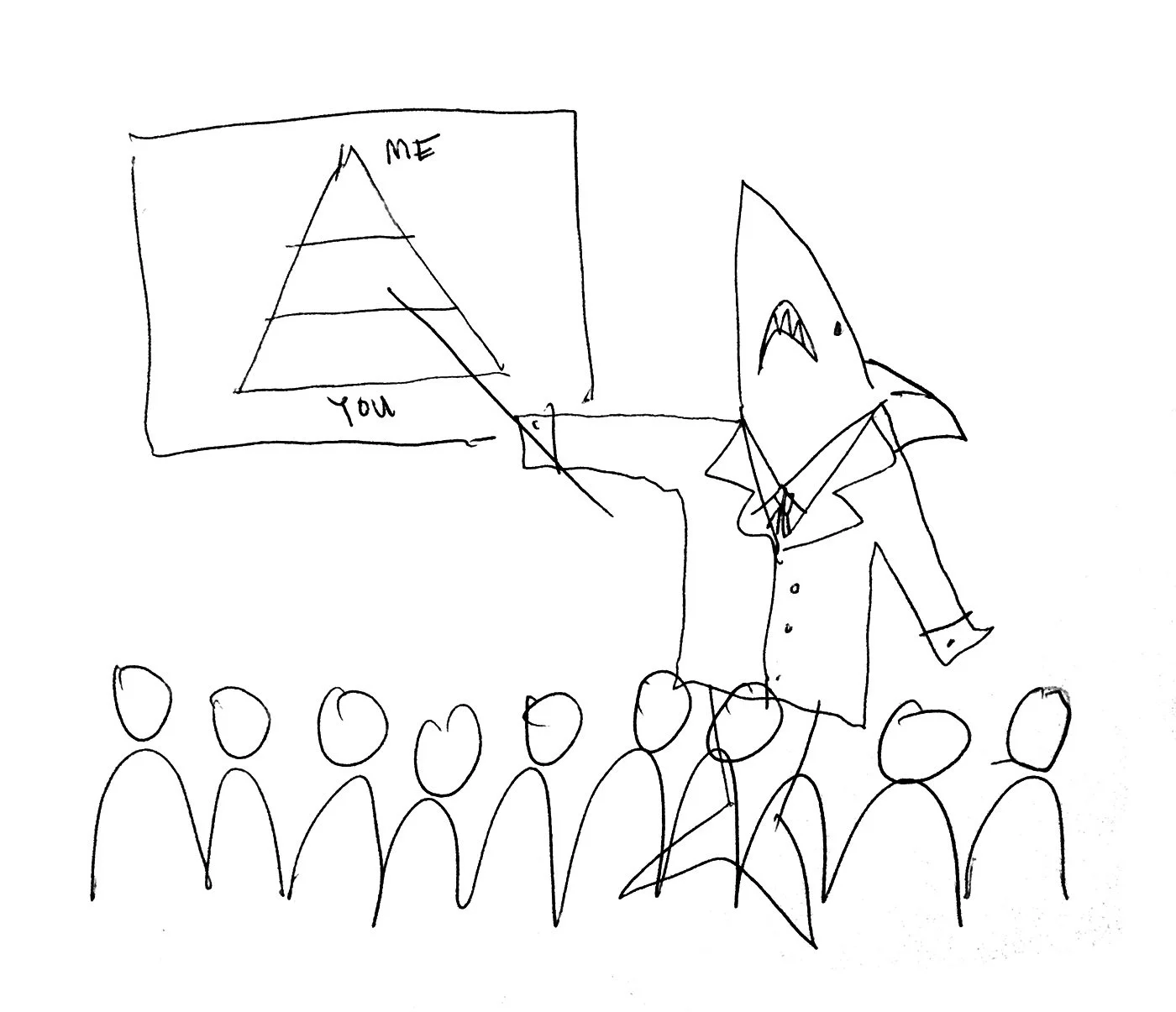

"Trust Me, I’m A Sturgeon"

About The Flounder

I am Cole Hauptfuhrer 👋

Flounder & Chief Executive Offisher of Find Fat Fish, author of 12 Steps To Your First Stock, vagabonding speaker (NZ, Bali, Find Fat Fish’s Codcast), and Supreme Grill Sergeant of Find Fat Fish’s Swim School.

One of the few “finfluencers” who can powerfully answer “What is your best case study?” (I’ve helped people retire years or decades faster based on 8 weeks of training & 2 years of followthrough), I am a specialist in part-time focus investing.

Disturbed to learn I was an English Major training to become a verbal acrobat, my dad yanked me out of college and taught me investing in one week on a cruise ship. I went from knowing nothing about stock-picking to quadrupling my first investment—then rolling those proceeds into even-fatter winners that are sitting in your kitchen—using simple principles I teach people in my Your First Stock® workshop.

After 19 years of investing as a hobby to fund the life I want to live, this continues to amaze me: investing is the most lucrative & lazy-intelligent skillset on the planet but it’s taught well damn near nowhere. So I’ve built Find Fat Fish to do for you what my dad did for me. (If, and only if, you’re ready.)

“If you invest $1,000 in a stock, all you can lose is $1,000, but you stand to gain $10,000 or even $50,000 over time if you’re patient. The average person can concentrate on a few good companies, while the fund manager is forced to diversify. By owning too many stocks, you lose this advantage of concentration. It only takes a handful of big winners to make a lifetime of investing worthwhile.”

“The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It’s a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that.”

Hmm. Still “researching”, eh? Here’s what more Finatics say…

“I have just done the numbers and surprised even myself. On today’s figures, since working with Cole just over 2 years ago I have increased my net worth by 715%.

Dan R.

Cairns, North Queensland, Australia

“Not only have we succeeded in our investing but it’s spurred us on to start other businesses that are well on their way to succeeding.”

Kevin & Missie C.

San Francisco, California, USA

“Prior to this course I was remarkably ill-suited to choose my own investments. In the past two years my Fat Fish portfolio has gone up by 150% and more than $200,000. I know it’s not about the short-term, but my investments are making me more than my actual job is and that feels pretty badass."

Jerome C.

Boston, Massachusetts, USA

“I now consider myself self-sufficient in the world of stock investing. I have a growing portfolio of companies, which I am able to select and research on my own. The saying, ‘give a man a fish and you feed him for a day, teach a man to fish and you feed him for a lifetime’ accurately describes the before and after of Cole’s workshop.”

Ross T.

Boston, Massachusetts, USA

“I've always said the biggest difference the workshop has made for me is the fact that it's completely changed my attitude towards money, and it wasn't until recently I quantified how much. My net worth today is 315% of what it was this time last year.”

Suyeon S.

Wellington, New Zealand

“Find Fat Fish compelled me to invest in Amazon and Netflix back in 2010. I turned my first investment into my wife’s wedding ring, and the AMZN and NFLX I’ve got left are up more than 2,200% and 4,800%.”

Russ C.

Los Angeles, California, USA

“Cole has created an effective workshop for investing that frankly surpassed any investment course I have taken as a recent graduate from Columbia Business School… Find Fat Fish offers a skillset that can change lives.”

Miranda C.

New York, NY, USA

“Cole was very patient, warm, and understanding when it came to my 0.00 knowledge about investing and minimal financial literacy. He took the time to ask me powerful questions that helped me understand my financial situation better and his tactic for explaining and teaching me was super grounded and easy to understand. With his help I took the plunge and bought my first stock which has been a successful investment!”

Natalie H.

Los Angeles, California, USA

“This course allowed me to clear away the noise and turn my mindset from being a mindless spender into an opportunistic investor, which has enabled me to double my portfolio in two years. Something that usually takes 7 to 10 years with index funds.”

Hannah T.

Sydney, New South Wales, Australia

“Hey Cole! My portfolio has performed exceptionally well over the last 18 months and I’m planning to lean back into it over the coming months as I work on Investing 2.0… My kids’ Sharesies accounts are both +50% up! Great start towards house deposits.”

Anthony G.

Auckland, New Zealand

“I am confident this workshop is the cornerstone of us strengthening our financial future towards retirement age through Cole's business fundamentals which I am also applying to our farming business. A massive thanks to Cole.”

Paul S.

Camperdown, Victoria, Australia

“Best investment I ever made… I taught my financial advisor a lot! Then fired him.”

Russ S.

Washington DC, USA

“We’ve become completely detached from our presupposed notion that it was getting too late to become financially free."

David & Susan S.

Maryland, USA

“Our net worth has doubled since we did the course 2.5 years ago… 55% CAGR vs 23-24% SPY.”

Tyler & Amanda D.

New Plymouth, New Zealand

“This course took a novice with no idea whatsoever in the world of investing and transformed me into an investor with savvy, guts and the methodology to be successful. The fear of the unknown is gone and is replaced with a plan and step by step procedure.

Looking back, I’m grateful we took that leap of faith that brought us to where we are today. Again, thank you Cole for opening the door and showing us the way.”

Doug & Joanne F.

Alberta, Canada

“Cole I’ve not only really enjoyed the course (despite struggling time wise during a “perfect storm” in my business) but I’m truly grateful thanks for giving me a new outlook on my life and way forward into retirement. It has galvanised me into taking action on things I’ve been thinking about and procrastinating on for 5 years - selling my businesses etc and simplifying my life.”

Vince S.

Tauranga, New Zealand

“The future looks so bright… I am so glad I found Cole. His guidance and mentorship taught me how to evaluate stocks and more importantly gave me the confidence to build a more concentrated portfolio. The more concentrated I get, using the principles taught in the workshop, the more success I have. What used to be just a dream, my comfortable retirement and spending time with my family is now a reality, thanks to Cole. And it will happen several years sooner. I just wish I had found Find Fat Fish earlier.”

Carla W.

Pennsylvania, USA

“Find Fat Fish provides the perfect approach to long-term investment because it synthesizes the analytics that I encountered during business school into simple, crucial questions that make up the foundation of value-based investing.”

Paul C.

New York, USA

“Hey mate, how are you? I don’t know if you remember, but you took me through a crash course on your principles on investing a while back. I invested $80k in 2022, in four companies and the stocks have more than doubled in value. Additionally, when Walter was born I researched four companies and decided to continually invest $50 a fortnight into these companies for Walter’s future. They have made close to a 60% return in value too.

Thanks again for the advice Cole. Every time I look at my portfolio, I have a smile that you couldn’t remove with a wire brush.”

Dave (and Walter) T.

Rotorua, New Zealand

“I feel we have now obtained the tools that were left out of the tool box to make my job easier. All the tools are in the tool box and I am getting better at using them. I never want to experience the feeling of desperation and I now know I will not have this feeling.”

Andrew G.

Queensland, Australia

“I enrolled in the Find Fat Fish workshop back in 2017, and it has been the most significant step I have taken towards improving my personal financial health…

In these past 5 years, my account has more than tripled in value, and maybe more significantly taking this course has provided me the financial freedom to leave a 9 to 5 job and start my own consulting company.

Honestly, if you want to take control of your own finances and you are willing to commit to a few months of work, then I strongly recommend working with Cole.”

Posted by Jerome Chiu

“Full disclosure, I am a pretty guarded, methodical, and pragmatic individual when it comes to my hard earned money. From my very first meeting with Cole he seemed to genuinely care about what it is I was looking for and what I was trying to do…

If you are one that is searching…really looking for ways to take control…and you are willing to do the work, I strongly recommend working with Cole. The program helps individuals tackle the uncertainties and creates an ability to calmly make investing decisions…”

Posted by S Hewitt

“If you want to be financially free while learning not to panic and give in to the noise of over information, this course is the best thing you can do. I know my life has changed in the best way possible, I am trying hard to contain my excitement for the future cause it's going to be AMAZING!”

Posted by Ed Jefferies

“The Find Fat Fish workshop is absolutely the best way to become self sufficient at long term wealth building. Cole teaches the skills to pick companies that are primed for explosive growth and more importantly, prepares you mentally for the anticipated up and down movement of the markets… In 8 weeks, I went from the guy who trusted ‘professionals’ in 2008 and 2012 to taking control of my own financial using proven skills that have nothing to do with competing with wall street speculators…”

Posted by John Mugavero

“I came into this workshop completely overwhelmed by the idea of stock-picking. I felt like I’d never understand.

But with a little sweat equity and a mentor like Cole, you will utterly shock yourself with how quickly you can learn how to do this and be confident in your ability to do it…”

Posted by Rebecca K

“Cole is exactly who he presents himself to be. I was skeptical, but he enough spent time with me, laying out his roadmap, that I felt comfortable signing up. He delivered on his promise ten fold on teaching me how to fish so that I could continue feeding myself. One of his questionnaires was so thorough and thoughtful that I was emotionally moved by the wisdom he shared through that document. His process is a streamlined and well marked gateway that navigates the upstream falls leading to the still ponds. I unreservedly recommend Cole.”

Posted by Anne D. Hensley

“Find Fat Fish helped me realise that it’s legit okay to tap in to your own subjective interests, field research, and feelings (i.e. go with the gut) to make investment decisions, all while backing this with thoroughly worked-through analysis and strategy. And not to forget: addressing temperament – a vital part of the process.

Cole is a great teacher who has a knack for understanding individuals – he will decipher what you are saying and help you understand yourself as an investor.”

Posted by Bianca

“I highly recommend Find Fat Fish as a fresh-simple approach to investing with little to no technical jargon... The mentor, Cole, has vast experience in investing who was able to answer difficult questions and kept me positive at my most pessimistic times. I have learned and gained a long term approach to getting better returns for my investments which has set me up for life. Thanks Find Fat Fish!”

Posted by Stephen Lee

“As someone who had 2.5 years investing experience coming into Find Fat Fish's workshop I can honestly say Cole has completely changed the way I look at investing. I have made more progress than I would have in my lifetime, in just 8 weeks. The skills and confidence I gained are incredible and this workshop is something I would unreservedly reccomended to anyone.”

Posted by Steven

“Helped me come up with a system to stop trading and start investing for my future, while getting emotions and other common pitfalls out of it. Learned an easy system to verify if companies have good potential for growth and protection from going out of business, with the bonus of finding new potential picks to research in the process.”

Posted by Bob Masters

“A few years ago, I wanted to start investing money in stocks I picked myself vs. having a giant investing firm holding my money in vaguely legal-sounding funds, etc. There is so much noise and confusion about investing and I had serious trepidations but was anxious to learn…

Cole is a delight to work with. The training in the Fat Fish workshop is comprehensive, fun and has taken the "noise level " of investing to a manageable decibel. There is great support after the course as well with other graduates and the Fat Fish team. I couldn't be happier with my decision to take this course.

Find Fat Fish has enabled me to confidently pick my own stocks and I've never looked back!”

Posted by Jennifer

“Firstly, thanks to Cole and the team at FindFatFish. I'd been investing small sums of money into different stocks over the last 5-6 years. Doing aimless research into companies not really knowing what I was doing, then taking a gamble on selections my gut thought were good. Over the last 8 weeks I've learnt where to start, what to look for when selecting 'Fat Fish', and portfolio set-up and structure. I've sold off my existing portfolio and invested in 3 Fat Fish I have found.”

Posted by Nathan Tucker

“I knew nothing about stocks or investing before talking to Cole and signing up with Find Fat Fish. I'd always likened stocks to gambling and was incredibly hesitant about it. After doing this workshop I know that is so not the case. The course is built from the bass up to make sure you understand the principles of investing safely, and with purpose…

Whether or not you know anything about stocks to start with, this course is a game changer for your future. I fully and highly recommend Find Fat Fish to anyone who's interested in investing, and get your future set up for how you want it.”

Posted by Komali Wings

“This course has helped me overcome my fares of investing. No longer am I scared when I invest, I now invest with conviction. I can now find investments that will change my life. Investing has now become fun for my family and I. We are excited for the future ahead. We would like to thank Cole for helping us with the tools to succeed in investing.”

Posted by Robbie

“I went from initially being slightly sceptical and knowing nothing about choosing individual stocks to being converted and confident about choosing great stocks in a few weeks…

I absolutely 100% recommend the workshop to anybody sitting on the sideline contemplating this. Contact Cole, you will not regret it.”

Posted by Stuart Braddick